Ensure your CV layout is structured to best highlight your unique experience and life situation.

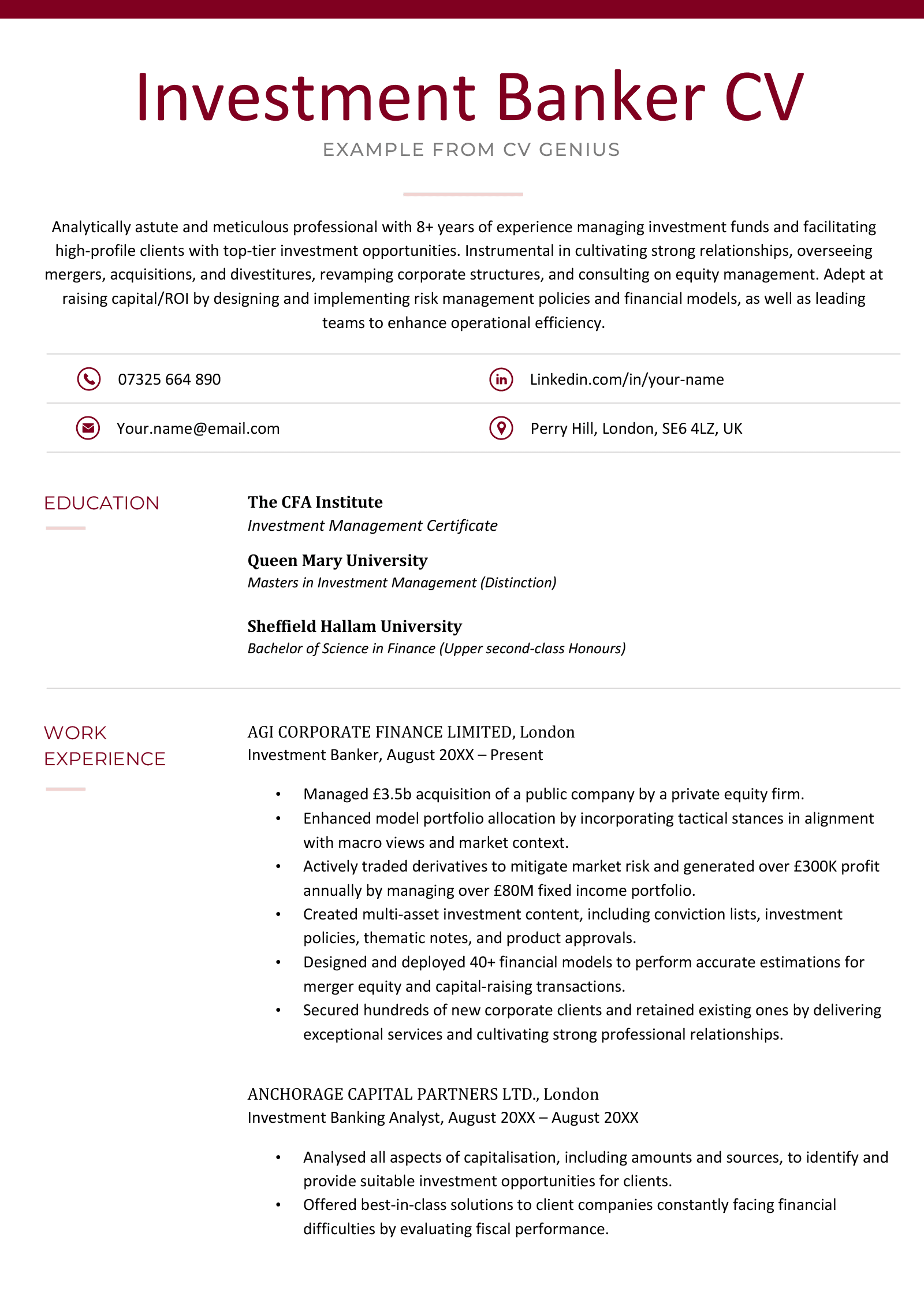

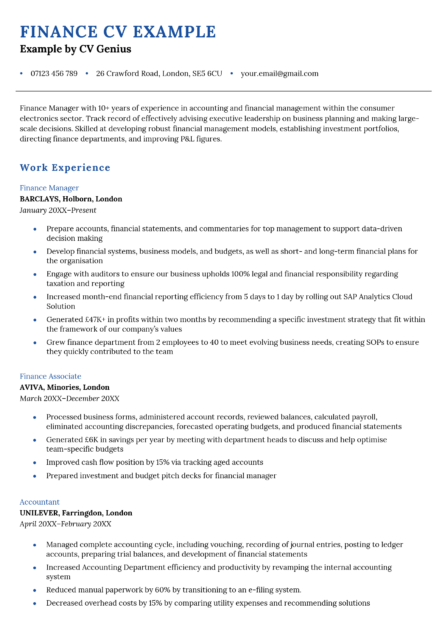

Investment Banker CV Template (Text Format)

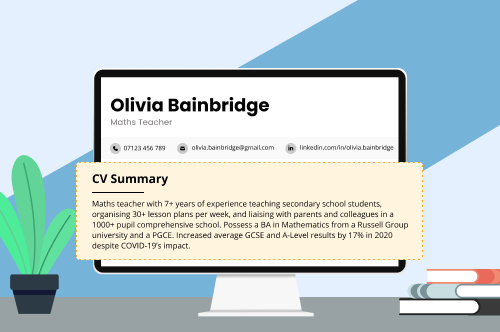

CV PERSONAL STATEMENT

Analytically astute and meticulous professional with 8+ years of experience managing investment funds and facilitating high-profile clients with top-tier investment opportunities. Instrumental in cultivating strong relationships, overseeing mergers, acquisitions, and divestitures, revamping corporate structures, and consulting on equity management. Adept at raising capital/ROI by designing and implementing risk management policies and financial models, as well as leading teams to enhance operational efficiency.

EDUCATION

The CFA Institute

Investment Management Certificate

Queen Mary University

MSc Investment Management (Distinction)

Sheffield University

BSc Finance (upper second-class honours)

WORK EXPERIENCE

AGI Corporate Finance Ltd.

Investment Banker, London, August 2020–present

- Managed £3.5 bil. acquisition of a public company by a private equity firm

- Enhanced model portfolio allocation by incorporating tactical stances in alignment with macro views and market context

- Actively traded derivatives to mitigate market risk and generated over £300K profit annually by managing over £80 mil. fixed income portfolio

- Created multi-asset investment content, including conviction lists, investment policies, thematic notes, and product approvals

- Designed and deployed 40+ financial models to perform accurate estimations for merger equity and capital-raising transactions

- Secured hundreds of new corporate clients and retained existing ones by delivering exceptional services and cultivating strong professional relationships

Anchorage Capital Partners Ltd

Investment Banking Analyst, London, August 2018–August 2020

- Analysed all aspects of capitalisation, including amounts and sources, to identify and provide suitable investment opportunities for clients

- Offered best-in-class solutions to client companies constantly facing financial difficulties by evaluating fiscal performance

- Collaborated with various professionals, including lawyers, accountants, and public relations experts, to execute M&A projects

- Boosted risk management department’s performance and productivity up to 4× by recalibrating existing policies and procedures

- Analysed and presented financial reports to senior leadership twice a week while training two junior analysts on overall operational functions

Fox–Davies Capital Ltd

Investment Banking Intern, London, July 2016–August 2018

- Maximised return on client investments by 47% through management of investment funds

- Assisted bankers in execution of several projects, including pitch books and implementation of mergers and acquisition mandates

- Prepared and presented slides to clients during weekly briefings

- Conducted in-depth market research to discover investment opportunities

- Resolved multiple issues related to risk management and trade by designing robust models

- Formulated weekly financial reports to update executive management

KEY SKILLS

- Portfolio Management

- Risk Control & Mitigation

- Strategic Planning & Execution

- Client Engagement & Retention

- Investment Proposals

- Banking Operations

- Market Research & Analysis

- Relationship Building

HOBBIES & INTERESTS

- Camping

- Meditation

- Music

- Football

You'll need a great investment banker cover letter too

Before you begin writing, make sure you know how to write a CV in a way that best emphasises your strengths.

Fortunately, you don’t need to spend hours agonising over your cover letter. Make one in minutes by using a good cover letter maker.