Ensure your CV layout is structured to best highlight your unique experience and life situation.

Finance CV Template (Text Format)

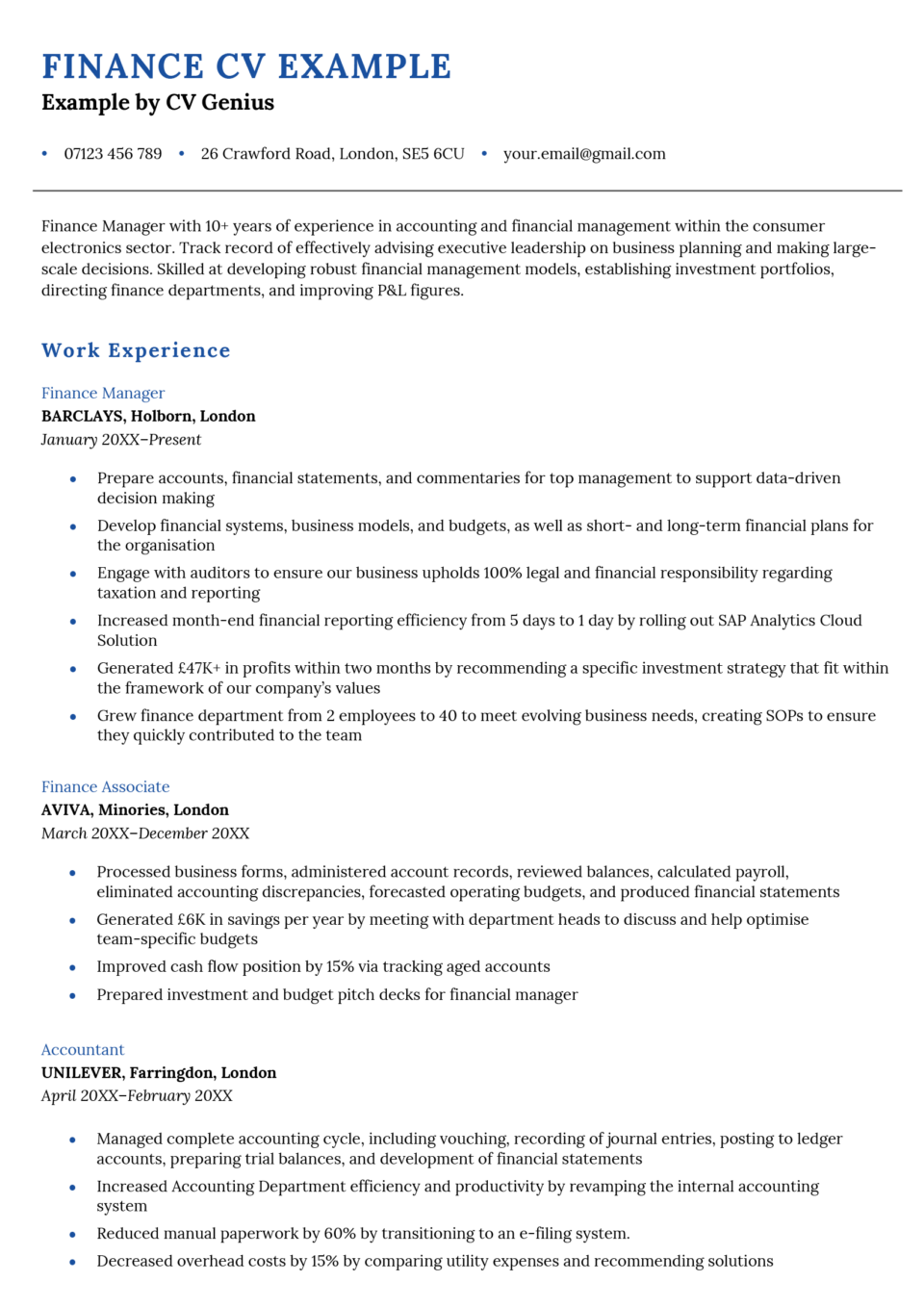

PERSONAL STATEMENT

Finance Manager with 10+ years of experience in accounting and financial management within the consumer electronics sector. Track record of effectively advising executive leadership on business planning and making large-scale decisions. Skilled at developing robust financial management models, establishing investment portfolios, directing finance departments, and improving P&L figures.

WORK HISTORY

BARCLAYS, Holborn, London

Finance Manager, January 20XX – Present

- Prepare accounts, financial statements, and commentaries for top management to support data-driven decision making

- Develop financial systems, business models, and budgets, as well as short- and long-term financial plans for the organisation

- Engage with auditors to ensure our business upholds 100% legal and financial responsibility regarding taxation and reporting

- Increased month-end financial reporting efficiency from 5 days to 1 day by rolling out SAP Analytics Cloud Solution

- Generated £47K+ in profits within two months by recommending a specific investment strategy that fit within the framework of our company’s values

- Grew finance department from 2 employees to 40 to meet evolving business needs, creating SOPs to ensure they quickly contributed to the team

AVIVA, Minories, London

Finance Associate, March 20XX – December 20XX

- Processed business forms, administered account records, reviewed balances, calculated payroll, eliminated accounting discrepancies, forecasted operating budgets, and produced financial statements

- Generated £6K in savings per year by meeting with department heads to discuss and help optimise team-specific budgets

- Improved cash flow position by 15% via tracking aged accounts

- Prepared investment and budget pitch decks for financial manager

UNILEVER, Farringdon, London

Accountant, April 20XX – February 20XX

- Managed complete accounting cycle, including vouching, recording of journal entries, posting to ledger accounts, preparing trial balances, and development of financial statements

- Increased Accounting Department efficiency and productivity by revamping the internal accounting system

- Reduced manual paperwork by 60% by transitioning to an e-filing system.

- Decreased overhead costs by 15% by comparing utility expenses and recommending solutions

EDUCATION

Middlesex University London (20XX–20XX)

BA (Hons) Financial Management, upper second-class honours (2:1)

Relevant Modules: Financial Accounting Theory, Corporate, Cost, Public, Managerial, Governmental, and Tax Accounting

KEY SKILLS

- Financial planning & analysis

- Accounting cycle management

- Financial reporting

- Cashflow optimisation

- Budgeting & forecasting

- Financial modelling

- Auditing & compliance assurance

HOBBIES & INTERESTS

- Running marathons

- Fine dining

- Volunteering for the NHS

How to write your finance CV: 4 tips

Before you begin writing, make sure you know how to write a CV in a way that best emphasises your strengths.

In finance, you’ll handle diverse finance-related responsibilities like proposing investment opportunities and budgetary changes to your superiors.

Employers in finance look for candidates that can demonstrate the breadth of their skills and experience in a professional and straightforward manner. So to prove your finance abilities, create a simple CV that reflects your:

- in-depth knowledge of the finance sector

- qualifications related to finance

- experience and achievements in the finance field

Follow these three tips to build a CV that persuades recruiters in the finance industry to invite you in for a job interview and ultimately invest in you as an employee:

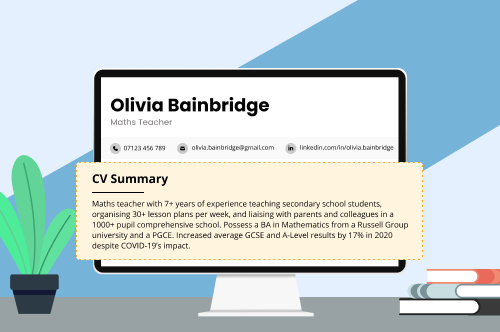

1. Draw the recruiter’s interest with a standout personal statement

High-quality CVs always have a personal statement at the top of the first page. A CV personal statement is the first thing a recruiting manager sees, so it’s the perfect place to include your top finance-relevant achievements, qualifications, and skills.

To write a powerful CV personal statement:

- bear in mind the type of finance role you’re seeking (e.g., audit, tax, compliance)

- analyse the job advert

- research the company you’re applying to

- build a profile of the recruiter’s ideal candidate

Then use your CV’s personal summary to demonstrate how you fit that profile.

Here’s an example of a personal statement written by a candidate applying for a finance manager role:

Finance Manager with 10+ years of experience in accounting and financial management within the consumer electronics sector. Track record of effectively advising executive leadership on business planning and making large-scale decisions. Skilled at developing robust financial management models, establishing investment portfolios, directing finance departments, and improving P&L figures.

A personal statement summarises your CV, so don’t make it too long. You can expand on the information you provide in your cover letter.

2. Highlight your professional qualifications

Working in finance, you’ll have the opportunity to pick up many different qualifications. Depending on the firm you work for, you may be required to study for these qualifications as you progress in your career.

For example, if you work for one of the Big Four Accounting Firms, you’ll normally be required to follow a programme of professional qualifications. For instance, if you join the popular Audit graduate programme at KPMG, you’ll need to study for various professional qualifications during your first few years.

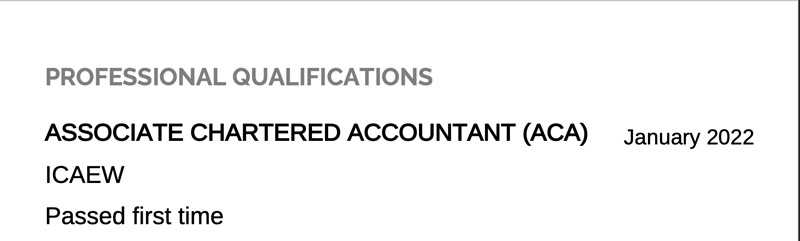

Once you’ve gained a professional financial qualification, showcase it on your CV so that recruiting managers can quickly see you’re qualified in the speciality they’re hiring for. Because professional qualfications are vital in finance, create a standalone professional qualifications section to group them together in an easy-to-find place.

Here’s how to highlight an ACA qualification on a CV:

You should add any other qualifications you’re studying to this section, as well as when you expect to gain them.

Check individual qualifications for organisations’ guidance on how and when to show them on your CV. For example, the ICAEW says you should specify if you passed your ACA exams the first time.

3. Highlight your finance skills (and learn new ones)

You should also create a skills section on your CV that specifies any skills you’ve picked up in previous finance roles or university modules.

If you’ve worked in the finance industry for a few years, you may have more skills than space on your CV to highlight them. In this case, look at the job advert for the finance role you’re interested in, and only add skills to your CV if they’re specifically listed there.

As well as your finance hard skills, don’t forget to add some personality-based soft skills to your CV. Although personal skills might not be mentioned in finance job adverts, these skills are still valuable in the finance sector because they prove you can work well with clients and colleagues, and handle your workload.

Here are some common soft skills that complement hard finance skill sets:

- Collboration skills

- Attention to detail

- Customer service skills

- Teamwork skills

- Communication skills

- Creativity

- Adaptability

- Presentation skills

- Positive mindset

- Working well under pressure

If you’re new to finance or are looking for new skills to pick up, consider some of these resources:

Twitter: @goldmansachs, @wallstreetmojo, @conorsen, @reformedbroker

Reddit: r/finance, r/financestudents, r/financialcareers, r/securityanalysis

YouTube: The Motley Fool, Bloomberg Finance & Markets, WisdomCA, TheFinancialDiet

Talking about how you’ve used these resources or discussing an interesting recent development in the financial world can also help you make connections with the interviewer if you use them when responding to common interview questions.

4. Highlight a finance-oriented personality

While it’s important to show recruiters you have the know-how to fill a finance vacancy, you should also prove that your personality fits the organisation you’re applying to.

If you have space on your CV, you can add a favourite hobbies and free-time interests section and fill it with activities that suit the profile of a finance worker. While you shouldn’t lie about your hobbies and interests, you can refer to lists of the best hobbies for the finance industry and add any you take part in.

Whether these hobbies help you hone skills you use at work or they help you connect with your colleagues, mentioning them on your CV could make the difference between getting an interview or not because recruiting managers will see you want to fit in and make a career in finance.

A cover letter is also standard in the finance industry, so create your cover letter online in minutes to complete your job application.