On April 1 2024, the UK’s national minimum wage rose to £11.44 per hour, an increase of 9.8% from the 2023 rate (£10.42).

This hike, the largest to date, is the first time the minimum wage has increased by more than £1.

We take a look at the new living wage pay rates, examine their value in real terms, and break down what you can expect to earn in different situations.

What is the ‘National Minimum Wage’ and ‘National Living Wage’?

The National Minimum Wage is the minimum pay per hour that all workers are entitled to in the UK. It includes the National Living Wage, which is the minimum hourly pay for workers over 21 years old (apprenticeships excluded).

How much you can get on minimum wage depends on your age and the type of work you do.

| 2024 Rate (£) | Increase (£) | Increase (%) | |

|---|---|---|---|

| National Living Wage | 11.44 | 1.02 | 9.8 |

| 18–20-year-old rate | 8.60 | 1.11 | 15 |

| 16–17-year-old rate | 6.40 | 1.12 | 21 |

| Apprentice rate | 6.40 | 1.12 | 21 |

This is the first year that 21–22-year-olds qualify for the National Living Wage, having previously received a lower minimum wage rate. Because of the change, minimum pay for this age bracket has jumped by £1.26.

Still, some people aren’t entitled to the minimum wage:

- company directors

- members of the armed forces

- people living and working in a religious community

- prisoners

- self-employed workers

- volunteers

The Low Pay Commission, the organisation that advises the government on minimum wage rates, estimates that there were around 1.6 million workers paid at or below the minimum wage in April 2023, around 5% of all UK workers.

You can use this free wage calculator to check if your pay meets minimum wage requirements.

How much is the National Living Wage increase really worth?

After adjusting for inflation, the National Living Wage increased by about 7.8% compared to last year.

Inflation is the process by which goods and services get more expensive from year to year, meaning that the same amount of money buys less over time.

This year’s pay rise exceeds inflation, meaning more money in your pocket. But high inflation throughout the past decade means that pay packets may have weakened in the long term.

According to Paul Nowak, General Secretary of the UK’s Trades Union Congress, the minimum wage needs to be raised to £15 ‘as soon as possible’ for Britain’s lowest earners to remain ahead of rising living costs.

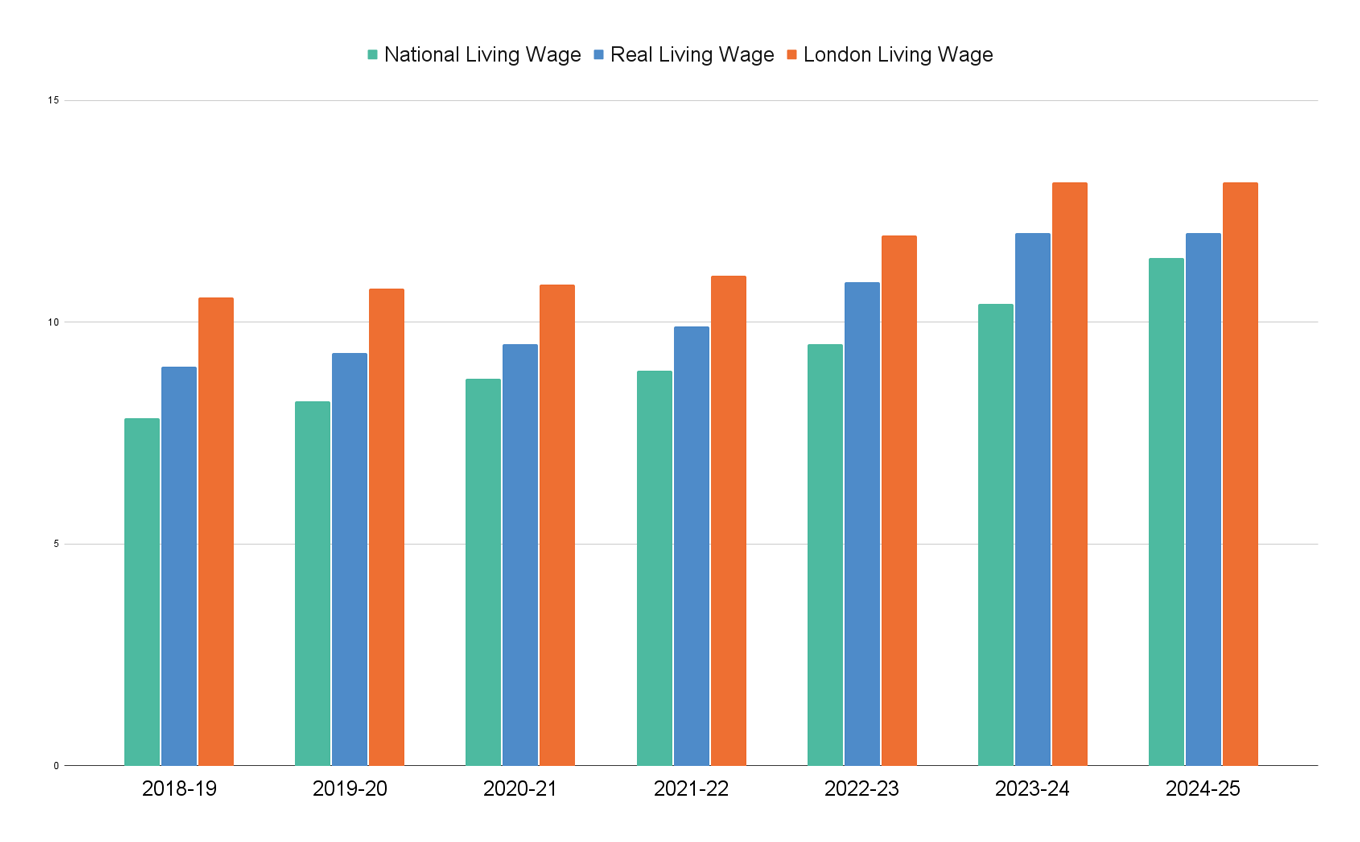

The ‘National Living Wage’ vs the ‘real Living Wage’

The real Living Wage is an independent optional wage rate set by the Living Wage Foundation. In 2024, the real Living Wage is £12 per hour across the UK and £13.15 per hour in London.

Unlike the government’s National Living Wage, which is a percentage of median (average) weekly earnings, the real Living Wage rate is based on the cost of a basket of household goods and services.

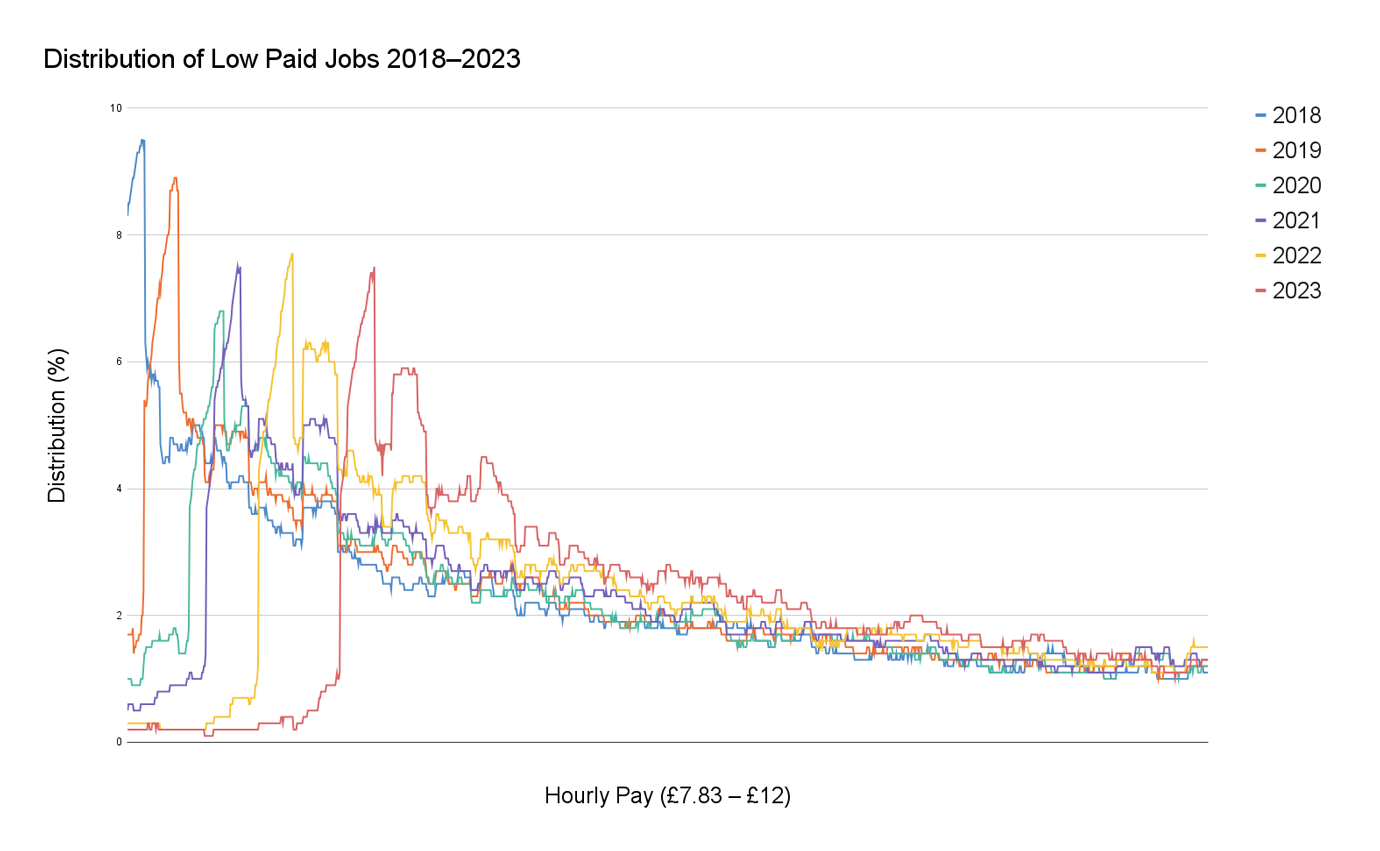

The National Living Wage has consistently failed to keep pace with increases in the real Living Wage and London Living Wage, though ONS data on low-paying jobs suggests that an increasing number of employers are voluntarily paying workers slightly more than the national minimum.

As a result, the real Living Wage is a more accurate measure of the pay workers need to receive in order to support themselves and cover surprise costs. According to the LWF, there are over 14,000 living wage employers in the UK.

Here are a few examples of companies that the foundation lists as paying a real living wage:

- Nationwide

- Monzo

- NatWest

- Radfield Home Care

- Scottish Autism

- WessexCare

- Acciona

- Elkins Construction

- Gunning London

- Royal Albert Hall

- Glasgow Film

- Royal Academy of Arts

- Dalston Superstore

- Curzon Cinemas

- Coaltown

- Adult Learning Wales

- OneEducation

- Association of Colleges

Impact of living wage increases

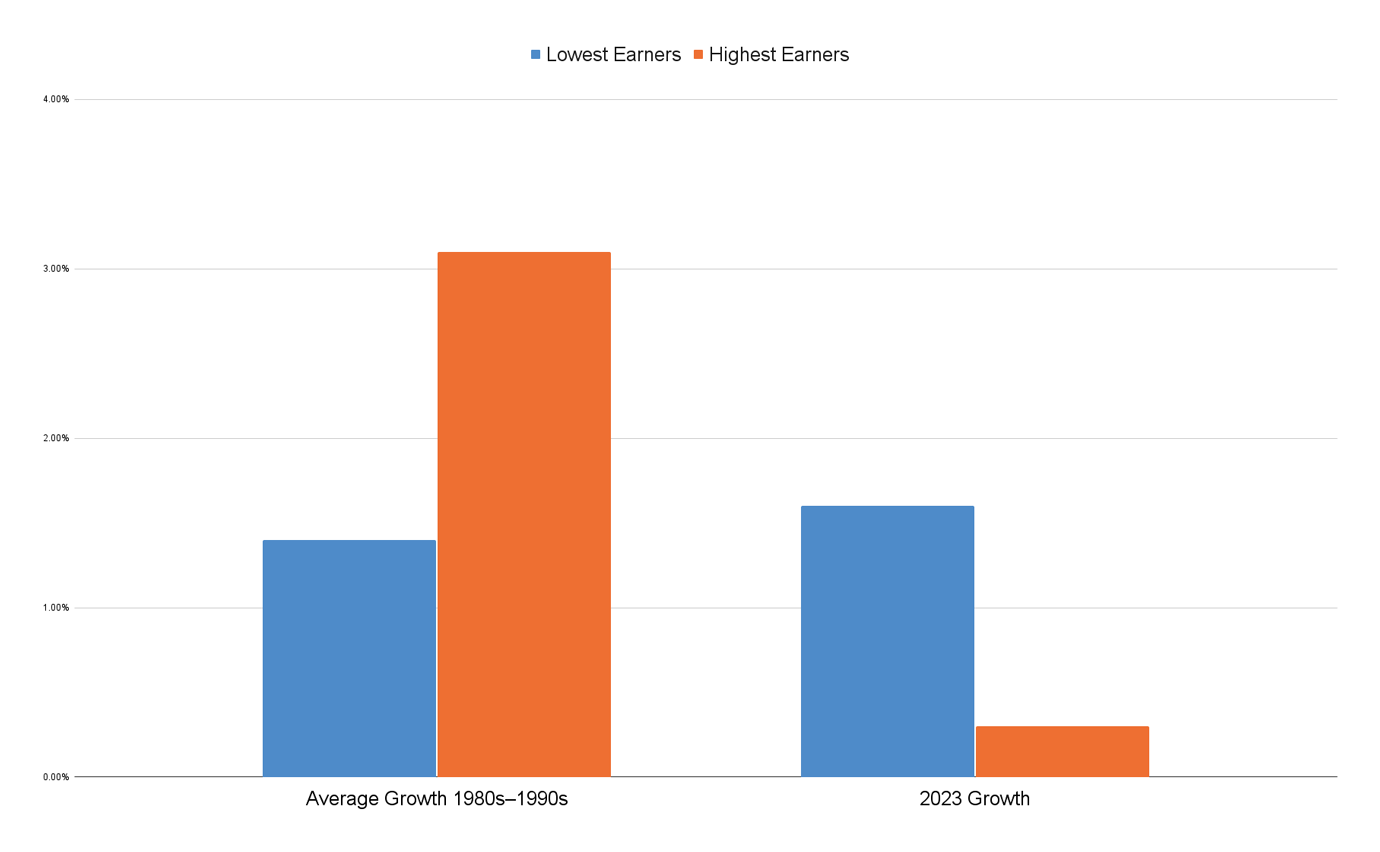

Considered one of the UK’s most successful economic policies, annual minimum wage rises have increased the annual incomes of Britain’s lowest earners by £6,000 since the policy was introduced in 1999.

The national minimum wage was introduced 25 years ago to reverse widening income inequality. According to the Resolution Foundation, during the 1980s and 1990s hourly pay rose almost twice as fast for the highest earners as it did for the lowest earners — 3.1% per year compared to just 1.4% per year. In 2023, pay rose by 1.6% for the lowest earners, compared to 0.3% for the lowest earners.

Additionally, recent rises in the minimum wage accompany a fall in the number of low-paid jobs: jobs that paid under £10.59 in 2023.

Over the past six years, an increasing number of employers have raised pay above the legal minimum, with a growing number choosing to pay slightly above minimum wage.

Unfortunately, relatively few jobs pay £12 an hour, which is the amount that the Living Wage Foundation estimates is necessary to cover basic living expenses outside of London.

According to the ONS, the UK’s lowest-earning workers tend to be between 16 and 21 years old, often working in elementary occupations.

Low-paid workers are also more likely to work in specific industries. The Low Pay Commission identifies 18 low-paying sectors where a significant proportion of workers receive close to minimum wage (less than the 2022 National Living Wage +£1.50).

The industries with the largest shares of low-paid jobs in the UK include the following:

| Industry | Approximate share of low-paid jobs (%) |

|---|---|

| Childcare | 16 |

| Cleaning and maintenance | 24 |

| Education | 6 |

| Hair and beauty | 40 |

| Healthcare | 4 |

| Hospitality | 21 |

| Leisure | 12 |

| Office work | 8 |

| Retail | 13 |

| Social care | 7 |

| Storage | 9 |

| Transport | 15 |

2025 outlook for the National Minimum Wage

It’s likely that minimum wage growth will slow in 2025, with official sources predicting that next year the National Living Wage will likely rise to £11.89 per hour, with a range of £11.61–£12.18.

The new rate will remain at two-thirds of median earnings, the target for minimum pay set by the Low Pay Commission.

This increase would be roughly 45p (3.9%) more than the 2024 rate, which would keep pace with current levels of inflation.

What to do if you’re not being paid the minimum wage

Companies are required to pay the national minimum wage. Nevertheless, in February, 500 companies were named for paying below the legal threshold, including Greggs, EasyJet, and Estee Lauder.

If you think your pay might be below minimum wage and are unable to resolve the issue informally with your employer, Acas (the Advisory, Conciliation and Arbitration Service) has a detailed guide on how to address minimum wage non-payments.

Remember that UK employers don’t have to pay you for overtime, but your average pay for the total hours you work mustn’t be less than the National Minimum Wage.

Sources

- Living Wage Foundation (n.d.), ‘Accredited Living Wage Employers’

- Low Pay Commission (2023), ‘The LPC Has Updated Its Definitions of ‘Low-Paying Sectors’

- ONS (2024), ‘Labour Market Overview, UK: March 2024’

- ONS (2023), ‘Low and High Pay in the UK: 2023’

- Resolution Foundation (2024), ‘The Minimum Wage Is the Single Most Successful Economic Policy in a Generation, and Has Boosted the Wages of Millions of Britain’s Lowest Earners by £6,000 a Year’

- UK Gov (2024), ‘National Minimum Wage and National Living Wage Rates’

About CV Genius

CV Genius is the go-to resource for UK job seekers of all industries and experience levels.

With an intuitive CV maker, a diverse collection of free industry-specific resources like cover letter examples and CV templates, as well as guides on how to write a perfect CV and cover letter. CV Genius has been featured in multiple renowned publications, such as the BBC, HR.com, MSN, Forbes, and Glassdoor.

CV Genius and its team of career advisors and HR specialists can help anyone make an effective job application and earn more interviews.

For media inquiries, please contact us.